Bitcoin and Ripple – The Democratization of Finance

January 21, 2014 § 24 Comments

I’ve always loved tech. From my first iPhone to exploring different apps to reading about Silicon Valley, I enjoy thinking about how technology makes our world more open and connected. This fascination has matured in me: At first I was somewhat of an early adopter; I’d read pop articles on Forbes–the innovation is exciting, and there’s money to be made. But in the past two years, through studying philosophy, religion and other cultures, I’ve thought deeper about how the world has changed through Internet innovators like Google and Facebook. These innovations and others allow and encourage a consciousness of all people; and further, they diminish ignorance and ethnocentric tendencies. For example, my government can’t use drone strikes without the damaging effects being readily known to me. These things make us think. Peoples’ steadfast belief in this political system or that religion is easily challenged–belief and opinion are readily discussed and tested. The Internet can be thought of as the free market for information, with those beliefs/opinions/ideas that are unsound or plainly false, being ruled out over time. Of course there are ways around this if we actively pursue ignorance, and in some ways these innovations fail to be as encouraging of openness as is ideal. But one cannot deny the openness and increasing conscientiousness the Internet has enabled. How does Bitcoin interact with this? What is Ripple? The larger question: what effect will digital currency and monetary systems play in our world’s future. I think the effect will be profound; and to borrow from an IBM executive architect’s words, “I believe they are going to change the world.”

Bitcoin (BTC)

Bitcoin is the first-mover. If you want to disregard it as “money” out of thin air, first realize that that is precisely how the U.S. Government creates dollars every day. But Bitcoin isn’t under control of any government, and this is what encouraged early adoption. More recently, the hype often surrounds the soaring (and volatile) value of this coin and the resulting “Bitcoin millionaires.” But many people are clueless or confused (I often still feel lost) about many of the basics of Bitcoin. Many people hear the hype, see the money, and buy in, hoping for a good investment (I may still do this). But all of that is only so exciting. What is truly intriguing is the system–the protocol–that makes Bitcoin such an innovation.

The basics:

The Bitcoin protocol is a distributed peer-to-peer network that allows transfer (reassignment) of bitcoins between parties. What does that mean exactly? Anyone can send payments to anyone else, in bitcoin, through the protocol. Who runs the protocol? The same people that run the internet; that is, anyone who chooses to. What incentive is there for people to run the Bitcoin protocol? People who run the protocol are known as miners; they are rewarded in bitcoins in a complex process called proof-of-work. The mining process is essential in that it predictably releases bitcoins into the money supply*, and, more importantly, the process is coupled with transaction completion, record, and final confirmation. This is done securely and without a central authority or intermediary; all participating servers broadcast and verify transactions. Transactions that are essentially “questionable” (e.g. attempting double spending) will ultimately be rejected; “honest” transactions are legitimized through several rounds (formally known as ‘blocks’) of verification and are then finally confirmed.

*There is a final cap on the amount of bitcoins that can be created: 21 million. However, after this, miners will continue working for transaction fees.

This leads us to the key innovation of Bitcoin: decentralized trust. Acting through this secure, decentralized mechanism to confirm transactions, Bitcoin introduces something the smartest people never thought was possible. Banks or other entities exist as a centralized authority and intermediary in financial transactions. If I swipe my debit card at a merchant or enter my credit card number online, the vendor contacts the issuing institution (bank or credit card company) to verify funds are available–this brings to bear a central authority that we generally trust. Other financial intermediaries and services like Paypal, Western Union, and Venmo act similarly but in a variety of niches. These entities charge fees, though. For example, to send $1,000 domestically, with the funds made available same day, Western Union charges a fee of $86. Bitcoin’s technology accomplishes this task securely, without an intermediary, and without sharing personal information, for a very nominal fee. If we think about sending money globally, the implications are magnified. Fees aside, the technology being used by financial institutions is slow to process transactions. In our increasingly tech savvy world, it might now seem odd that one has to wait days to receive their funds or have payments clear. Sending money overseas to a friend or a nonprofit cause will necessitate the use of several intermediaries as there is no global central authority to process these transactions. This takes time and incurs fees. Bitcoin makes it as easy as sending an email.

Ripple is much more than Bitcoin. Ripple is a currency agnostic monetary system. To use an analogy: email in the ’70s was available, but only through separate intranets–the networks were segregated. It’s 1982; enter the Simple Mail Transfer Protocol (SMTP); this innovation federated email into one technology that enabled anyone to message anyone else globally. Through the Ripple protocol you can store, trade, send and receive payments in any currency–digital or fiat (USD, CNY, MXN, BTC). Further, I can pay someone in my currency and they will receive it in their currency. For instance, if I were to send a Chinese friend $20, he will receive it in Yuan (using the email analogy: I can send an email in English to my Chinese friend and he will receive it in Mandarin). Another example–fiat to digital–if I want to pay a Libertarian friend of mine in bitcoin, I can do so using my USD; he won’t see anything other than bitcoin on his side of the transaction. The Ripple protocol federates currencies; it truly is “the Internet for money.”

But Ripple is different in some ways that draw skepticism. Firstly, it was created by a private company: Ripple Labs (formerly OpenCoin). The Ripple protocol was created with currency (XRP, or ‘ripples’) built into the network; all 100 billion, the maximum, were created up front. This has fueled skepticism and distrust, especially because the Ripple Labs founders have kept 20 billion XRP, with the remaining in Ripple Labs’ control for funding operations, distributing and giving at their discretion. As of November 30th, 2013, approximately 7.2 billion XRP have been distributed, with over 72 billion remain in holding. This, in comparison to Bitcoin’s predictable (perhaps fairer) supply of coins, could be crippling the protocol’s adoption. However, Ripple makes it clear that only a small amount of XRP is required to fund a wallet (join the network). Once that is done, you can use whatever currency you prefer within Ripple. Given this, focus on XRP value may be an indicator one is solely a digital currency speculator, which is fine, but those efforts are best pursued elsewhere. Investing in Ripple should be an investment in more than the currency; the currency agnostic protocol is the real innovation. Why a requirement of XRP? Ripples serve an essential function in that they stop ‘network spam.’ Because a small fraction of an XRP is destroyed in each transaction (this is the only transaction fee), any person trying to overrun the network will be stopped by depleting their required reserve of the currency.

Bitcoin vs Ripple: Intermediaries and Centralization

Part of Ripple’s monetary system is the gateway; these entities act as intermediaries between people and the protocol—these are how you get your paper into digital form and vice-versa. Gateways have been criticized for making the network rely on intermediaries; this because gateways will take on a “hub and spoke” pattern as users who wish to withdraw or deposit their fiat currency must go through these bank-like entities, who, in the future, will undoubtedly use fractional reserves. Ripple’s use of “IOUs“ seems to exacerbate this issue. However, Bitcoin exchanges introduce a similar issue; if you wish to purchase or sell bitcoins—if you wish to use currency other than bitcoin—you must utilize centralized exchanges that also incur counter-party risk. But basically, if you’re using Ripple with XRP only or if you’re just using Bitcoin, then you’re on a decentralized network with autonomy of your assets and no need for an institution. But because Ripple wishes to be all things to all people—to federate currency exchange and payments—gateways are an emphasized part of the plan. Gateways will be an accessible tool for common people to use digital currency when they need or want along with their traditional currency. This also fits with Ripple Labs’ strategy of being regulator friendly; gateways, like Bitcoin exchanges, will strive for compliance through anti-money laundering and “know your customer” practices. Where Ripple emphasizes gateways, Bitcoin, perhaps to the extent the users are Libertarian, can dodge the use of exchanges and their regulators. Further, with tools like Darkwallet, Bitcoin will surely be the more attractive choice for those wishing complete freedom and privacy.

The Democratization of Finance

I recently flew out of LAX for some training in DC. When my cab picked me up, the driver was an older guy, his clothes were quite wrinkled and he looked worn out. We talked for a bit; he was genuinely nice, but as sometimes happens, the conversation died out as the ride continued. I began to notice the ride wasn’t very smooth, though, so I got off my iPhone to avoid feeling carsick. I noticed to my dismay that my driver was actually closing his eyes from time to time–he’d actually have to swerve a bit to correct after drifting out of his lane. Mostly out of self-interest, I started another conversation with him: I asked him where he was from. He was from Bangladesh. I asked what brought him here. He had come here for work because he couldn’t provide for his family by working back home. And his family stayed in Bangladesh. I felt strong compassion and continued to talk with him (forgetting that I was also keeping him awake). He’d been working here 12 years between taxi and valet service to continue to provide for them; and he’d send as much pay back as he could regularly.

International remittences are one area of finance that Bitcoin technology will help democratize. Democratize: to make (something) available to all people. Remittances to developing countries were estimated to reach $414 billion in 2013, which is an increase of 6.3% over previous year. And this growth is expected to continue due to globalization and migrating workers. Top recipients of officially recorded remittances are India ($71 billion), China ($60 billion), the Philippines ($26 billion), and Mexico ($22 billion). Other large recipients include Nigeria, Egypt, and Bangladesh–most are developing countries. The average cost to migrant workers for sending funds: 9% (WorldBank). My friend the cab driver shouldn’t be paying 9% in fees to get his wages to his family–not with our increasingly Internet savvy world. And of course, all of this–Bitcoin and Ripple technology–depends upon Internet access.

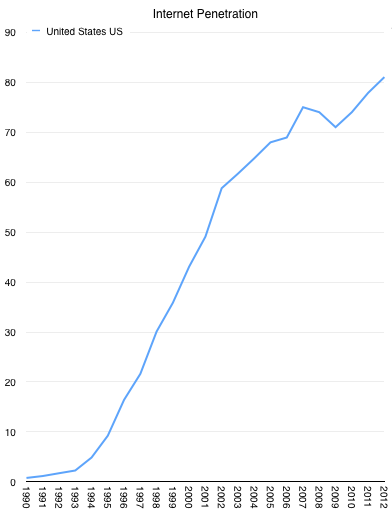

For me in the U.S., Internet access has become the norm:

(Horace Dediu, Asymco; data source is ITU)

(Horace Dediu, Asymco; data source is ITU)

But the current stage of growth is different in each country (though the stories, similar):

(Horace Dediu, Asymco; data source is ITU)

(Horace Dediu, Asymco; data source is ITU)

As discussed at the outset of this post, the Internet has given us the freedom to be informed and to communicate. As a millennial born in the U.S., I, without thinking, might intuit that the world has the same advantages of communication and information as me. But the reach of the Internet is still largely in its growing stages, as seen below in composite:

(Horace Dediu, Asymco; data source is ITU)

Thus far Internet access has democratized information and communication. What Bitcoin’s innovation really means is the democratization of finance–of transactions, of conducting business instantly worldwide and with complete freedom. It’s the Internet for value. People will have autonomy and privacy with their assets, and they won’t be reliant on a bank being in their town or a grant from their government. International remittances are just one application. People affected by natural disasters, corrupt governments or war will be able to protect their assets. And those wishing to help can send aid directly to those in need–without lag in time or fear of a different party seizing the asset. This technology is exciting; it’s going to help us build a better world.

Disclosure: I own <$500 combined worth of both BTC and XRP.

BTC: 1CzirX8aQMvfsr6uVCSTKzER1Tn2HEtLSb

XRP: rnFvjyfe184HUK6ea1ymT4cxnRTkMsMnnM